Aurum PropTech: Building the Future, Byte by Brick

Have you ever looked at a beautiful butterfly settle right before your eyes and wondered that how it changed from a caterpillar crawling on the ground, to shedding its old body, and finally emerging as a vibrant butterfly soaring through the skies?

Well, today we are looking at such a company whose life cycle changed just like of a butterfly, from changing many bodies and now became a bright and lively butterfly flying in the sky.

Caterpillar Stage: The Early Steps

Imagine a little caterpillar starting its journey, small, steady, and full of potential. In 1992, that caterpillar was MajescoMastek, formed as the US subsidiary of Mastek. MajescoMastek wasn’t a flashy business; it quietly helped insurance companies run smoother. Think of it as building smart digital tools that made it easier for people to buy and manage things like car, home, and life insurance. For years, Majesco was dedicated to making the insurance world more efficient and customer-friendly, growing steadily in the background, just like a caterpillar nibbling away and preparing for something bigger.

Pupa Stage: Major Transformations and Big Changes

Then came the pupa, a time when big changes happen inside, hidden from the outside world. In 2015, Majesco, after years of steady work as a Mastek subsidiary, split off to become an independent company.

Why?

Because the two branches of Mastek had very different needs, insurance technology needed loads of investment and innovation, while the main Mastek business was built for steady, safe growth. By separating, each could finally focus and grow in its own way. Majesco, as the insurance tech company, continued to innovate and even consolidated all its international insurance business under one roof.

The next major transformation came in 2020, when Majesco USA, the heart of the business, known for helping insurance firms become digital leaders, was sold to a giant investment company, Thoma Bravo.

This was like the caterpillar inside the pupa: Majesco India was left as an empty shell, no active business, but still with a valuable public listing and some money from the sale, quietly waiting for its next form.

Butterfly Stage: The New Aurum Proptech Spreads Its Wings

Now, imagine the pupa finally splitting, and a colorful butterfly bursting out to claim the sky.

In 2021, Aurum Ventures, a company with big dreams in real estate technology, saw a huge opportunity. They took over the “empty shell” of Majesco, not for insurance, but to build something brand new using the company’s valuable listed status.

With fresh leadership of Ashish Deora (CEO of Aurum Ventures) and a new vision, the company was reborn as Aurum Proptech. No longer about insurance, it became India’s only fully integrated technology ecosystem for real estate, serving home buyers, sellers, renters, and businesses across every part of the property journey.

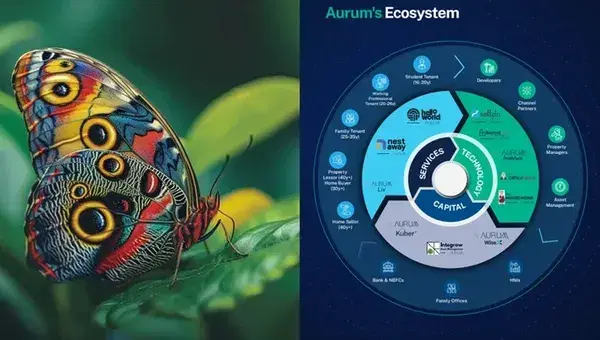

Today, Aurum Proptech is India’s only company offering a fully integrated technology ecosystem that covers the entire real estate value chain. It offers digital solutions not to just businesses, but for everyone in the real estate world, with a complete suite of C2C, B2C, and B2B products and platforms, leading innovation and making the market smarter, simpler, and much more connected.

Much like a butterfly, Aurum Proptech’s journey started slow and quietly, hid away for a time during big changes, and finally emerged as a vibrant leader, flying high, embracing new challenges, and showing what real transformation can look like.

The Butterfly Up Close: Patterns of Aurum Proptech’s Business

Just like admiring a butterfly from a distance is beautiful, it’s when we look closer at the intricate patterns and colors on its wings that the real magic is revealed.

Aurum Proptech, too, is more than just a fast-growing company in the real estate sky. When we zoom in and explore its business closely, the unique designs and patterns of Aurum’s model, products and services come into sharp focus.

Think of Aurum as India’s most complete real estate butterfly not just pretty to look at, but engineered with precision across every wing. Where most companies focus on one piece of the real estate puzzle, Aurum has built an entire ecosystem that touches every person’s property journey.

The Three Wings That Make Aurum Fly

Wing 1: The Rental Revolution - Making Housing Hassle-Free

NestAway: Your Housing Best Friend

Think of NestAway as that friend who knows everyone in the city and can get you the perfect place without any drama. After Aurum bought it for ₹90 crores in 2023, it became their flagship for families and young professionals aged 25-35.

What’s brilliant about NestAway is how it eliminates every rental pain point you’ve ever experienced. No more losing sleep over broken ACs or dealing with cranky landlords. They manage over 18,000 properties across major cities, handling everything from finding the right place to collecting rent and fixing that leaky tap.

HelloWorld: The Co-Living Game Changer

Now, if NestAway is for families, HelloWorld is the cool cousin targeting students and young professionals aged 16-26.

Picture this: instead of cramped PG accommodations with terrible food and zero privacy, HelloWorld transforms regular buildings into vibrant communities. They operate 230+ properties across 15+ cities with nearly 18,000 beds.

Monk Tech Labs: The Brain Behind the Operation

Here’s where it gets interesting. While NestAway and HelloWorld handle the customer-facing side, Monk Tech Labs is the technological brain powering property management across India.

Think of Monk Tech as the operating system for property management. Their AI handles everything from rent collection reminders to maintenance scheduling. They’ve built specialized solutions:

- TheHouseMonk for residential properties

- TheOfficeMonk for commercial spaces

- TheMallMonk for retail locations

- MonkSpaces.AI for space optimization

Property managers and landlords pay licensing and subscription fees, creating a steady revenue stream while making property management effortless.

Wing 2: The Distribution Powerhouse - Supercharging Real Estate Sales

Sell.Do: The Sales Automation Marvel

Imagine giving every real estate business a superhuman sales assistant that never sleeps, never forgets a lead, and constantly learns to sell better. That’s Sell.Do in a nutshell.

This isn’t just another CRM. Sell.Do has become India’s most comprehensive real estate sales platform, automating everything from lead capture to closing deals. It integrates with 50+ marketing platforms, manages site visits, handles customer communications, and tracks post-sales processes.

Real estate companies pay licensing fees and subscriptions based on team size, with additional revenue from implementation services and premium features.

Aurum Analytica: The Marketing Mind Reader

Here’s where Aurum gets scary smart. Aurum Analytica analyzes over 150 million social profiles to identify potential property buyers.

Think about it - instead of randomly advertising apartments, they use AI to create “look-alike” audiences, finding people who behave like existing customers. They manage a network of 120,000+ real estate agents across India, providing market intelligence and competitor analysis.

It’s like having a crystal ball that tells you exactly who’s likely to buy a home and when.

BeyondWalls: The Broker Bridge

BeyondWalls solves a classic real estate problem: how do developers reach thousands of brokers without managing individual relationships?

They’ve created a digital marketplace where developers can share inventory with verified brokers, track commissions, and provide training, all through one platform. For brokers, it means access to multiple projects without the usual relationship hassles.

PropTiger: The Strategic Acquisition

In July 2025, Aurum made a power move by acquiring PropTiger through a ₹86.45 crore all-stock deal with REA India.

Here’s why this acquisition was pure genius: PropTiger wasn’t just another property platform, it was the missing wing Aurum needed to complete its butterfly transformation.

Founded in 2011 by Harvard Business School graduate Dhruv Agarwala, PropTiger had already solved the transparency problem in India’s confusing real estate market. By 2025, they had built relationships with 300+ developers across India’s top 8 cities and generated ₹95.5 crores in FY24 revenue with impressive 23% annual growth.

The deal structure was instead of paying cash, Aurum gave REA India 42,42,537 shares (5.54% stake) at ₹203.77 per share, making REA India a strategic partner rather than just a seller. This brought REA’s global expertise and deep pockets into Aurum’s ecosystem.

What PropTiger brought to Aurum’s butterfly:

- Direct access to India’s ₹38,000 crore residential real estate distribution market

- 350+ seasoned professionals specialized in primary sales brokerage

- Established brand recognition and consumer trust built over 14 years

- Complete transaction management from property search to possession

Wing 3: The Capital Revolution - Democratizing Real Estate Investment

AMSA SM REIT: Making Commercial Real Estate Accessible

Here’s Aurum’s most ground breaking innovation. For decades, owning commercial real estate meant having crores of rupees. AMSA changed that game completely.

AMSA SM REIT is SEBI-approved, allowing individuals to own fractions of Grade-A commercial properties, offices, malls, warehouses - with just ₹10 lakhs minimum investment.

Think of it like buying shares of a company, but instead you’re buying shares of premium commercial buildings. The units trade on BSE and NSE, you get regular rental income, and benefit from property value appreciation, all without dealing with tenants or maintenance.

WiseX: The Fractional Ownership Pioneer

Before SM REIT approval, WiseX served as Aurum’s primary fractional real estate platform, offering lower entry barriers and professional asset management.

Integrow Asset Management: The Institutional Player

For high-net-worth individuals and institutions, Integrow manages specialized real estate AIFs, construction financing, and development projects.

Aurum KuberX: The Smart Lending Revolution

KuberX uses AI to match borrowers with the best loan products across 30+ lenders. Instead of visiting multiple banks, customers get personalized recommendations through a streamlined 3-step digital process.

They offer home loans, business loans, personal loans, and loan-against-property, earning through processing fees and lender partnerships.

The Support Ecosystem: Making Everything Work Together

PropTech Pulse: The Knowledge Hub

PropTech Pulse positions Aurum as the thought leader in real estate technology, providing industry research, educational content, certification programs, and community building.

Aurum Liv: The Experience Platform

Aurum Liv focuses on the often-overlooked post-purchase experience, offering transaction management, legal support, interior design services, and community building.

The Butterfly Effect: How All Wings Work Together

What makes Aurum special isn’t just individual platform strength, but how they create a synergistic ecosystem:

Imagine you’re moving cities: you browse HelloWorld’s co-living spaces → rent a family apartment via NestAway → list your old home on Monk Tech Labs’ platform → use KuberX to finance your dream house → search new homes on PropTiger → invest leftover savings in AMSA SM REIT. At every touchpoint, Aurum earns a small fee—subscription, commission, listing, or management while you enjoy a seamless journey.

This integrated approach allows Aurum to capture value at multiple touchpoints in every real estate transaction, creating multiple revenue streams that reinforce each other.

Aurum PropTech Financial Performance: The Metamorphosis Behind the Numbers

Just as we admired the butterfly’s intricate wing patterns and synchronized flight, it’s time to examine the financial backbone that powers Aurum’s remarkable transformation. Like studying the physiological changes during a caterpillar’s metamorphosis, understanding Aurum’s financial journey reveals the true complexity behind its evolution from a struggling startup to a profitable PropTech ecosystem.

But here’s the thing about analyzing a growing PropTech company the traditional financial metrics don’t always tell the complete story. We need to look at the numbers with the lens of a company in transformation, not a mature business.

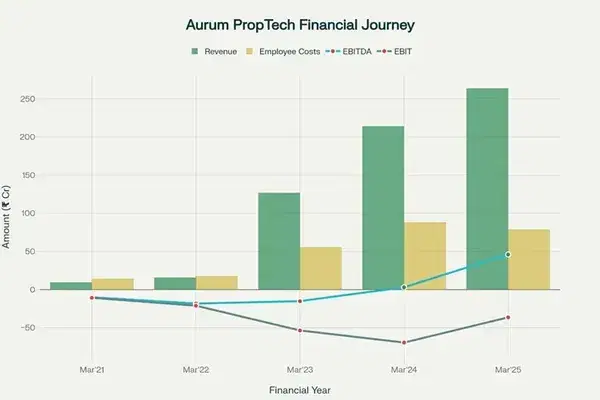

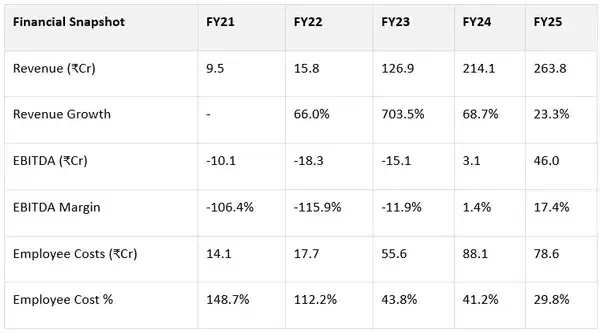

The Early Struggle (FY21-FY23)

Picture a startup burning through cash while figuring out its identity. During these years, Aurum was essentially burning cash to build its ecosystem.

Aurum generated just ₹9.5 crores in FY21, mostly from rent income. By FY22, IT services jumped to ₹15.5 crores while rental income nearly vanished. Employee costs consumed 148.7% of revenue in FY21, 112.2% in FY22, and 43.8% in FY23. The company was clearly hiring aggressively, building technology platforms, and acquiring businesses (remember the NestAway acquisition for ₹90 crores).

EBITDA losses ranged from ₹10-18 crores annually, with margins deeply negative. This wasn’t poor management; it was strategic investment.

The Inflection Point (FY23-FY24)

FY24 marked a crucial milestone, revenue hit ₹214.1 crores with the first glimpse of profitability; ₹3.1 crores EBITDA and 1.4% margin. Small, but proof the model works.

However, employee costs peaked at ₹88.1 crores (41.2% of revenue), suggesting the company was still in heavy investment mode.

The Maturation Phase (FY25)

Here’s where it gets interesting. Revenue grew a “modest” 23.3% to ₹263.8 crores, but EBITDA jumped to ₹46 crores; a healthy 17.4% margin. More importantly, employee costs dropped both in absolute terms (₹88.1 to ₹78.6 crores) and as a percentage of revenue (41.2% to 29.8%).

This shows operating leverage kicking in - the infrastructure built during loss-making years was finally generating sustainable profits.

The Hidden Story: What the Numbers Don’t Reveal

Acquisition-Driven Growth

The dramatic FY23 revenue jump coincided with major acquisitions. The ₹90 crore NestAway acquisition likely contributed significantly to both revenue growth and initial integration costs.

Scaling Challenges

The persistent EBIT losses even in FY25 (-₹36.4 crores) despite positive EBITDA indicate high depreciation and amortization costs, typical of asset-heavy PropTech businesses and acquisition-related goodwill amortization.

The Financial Health Check

What’s Working

- Revenue momentum: 5-year CAGR of 129.5%—that’s compound growth most companies dream of.

- Cost discipline: Employee costs falling as a percentage shows they’re not just throwing people at problems.

- Margin expansion: From -115.9% EBITDA margin in FY22 to +17.4% in FY25—that’s a complete turnaround.

Key Financial Concerns for Investors

- High Depreciation Burden: The gap between EBITDA (₹46 Cr) and EBIT (-₹36.4 Cr) in FY25 indicates significant asset depreciation, possibly from property assets and acquisition-related intangibles.

- Cash Flow Dynamics: While we see EBITDA positivity, the actual cash generation depends on working capital management and capital expenditure requirements.

- Acquisition Integration: The financial impact of recent acquisitions like PropTiger (₹86.45 crores) will be crucial to monitor in coming quarters.

The Verdict: Financial Foundation for Flight

Like a butterfly that’s successfully emerged from its chrysalis, Aurum has the financial foundation for flight. The question isn’t whether they can grow; it’s whether they can grow elegantly while managing the depreciation overhang and maintaining the cost discipline that finally brought profitability.

The numbers tell a story of successful metamorphosis, but the real test lies ahead: balancing expansion with the financial discipline that got them here.

Leadership and Visionary Strategy: The Architect Behind the Butterfly

Just as a butterfly has its creator, the intricate biological processes that guide its metamorphosis, Aurum PropTech’s remarkable transformation has its own architect. Behind this PropTech ecosystem’s evolution from a struggling startup to a profitable, integrated platform stands Ashish Deora, a first-generation entrepreneur whose vision and execution have shaped India’s real estate technology landscape.

The Creator: Ashish Deora - From 21-Year-Old Entrepreneur to PropTech Visionary

The Early Foundation (1996-2020)

Picture this: In 1996, while most 21-year-olds were figuring out their careers, Ashish Deora was founding Aurum Ventures. This wasn’t luck, it was vision combined with execution.

Deora’s educational foundation is impressive. A Harvard Business School alumnus who majored in Mergers and Acquisitions and Corporate Restructuring, he also completed the prestigious Owner President Management Program (OPM) at Harvard.

But what’s more telling than his credentials is his track record of building businesses across diverse sectors.

Before PropTech, Deora created India’s first optical fiber network company, IOL Telecom, in 1999. He built businesses in mining, aviation, renewable energy, and telecommunications - gaining the multi-industry experience that would later prove crucial in understanding real estate’s complexity.

The PropTech Vision (2020-Present)

In 2020, at age 45, Deora made a strategic pivot that would define his legacy. He founded Aurum PropTech with a clear vision: create an integrated ecosystem that brings “real estate, people and technology together”.

The Core Management Team: Building the Ecosystem

Onkar Shetye - Executive Director: The Operations Orchestrator

Shetye brings 15+ years of multi-sectoral experience across energy, real estate, mineral exploration, and IT. His background spans India, Europe, and Africa, providing global perspective to Aurum’s operations.

Kunal Karan - Chief Financial Officer: The Financial Backbone

With nearly 10 years at Aurum, Karan represents institutional memory and financial discipline. As a Chartered Accountant and CPA, he’s guided the company through its transformation from losses to profitability.

His long tenure (since 2015) through the company’s most challenging growth phases demonstrates commitment and effectiveness in capital allocation and financial management.

Experienced Management Team

The average management tenure of 4.2 years and board tenure of 4.1 years indicate stability and experience.

Compensation Alignment

Executive compensation ranges from ₹1.3 million to ₹38.75 million, with equity ownership creating long-term alignment. The variation reflects role complexity and performance contribution.

In a sector historically dominated by relationships and traditional practices, Deora and his team are proving that technology-driven, professionally managed companies can create sustainable competitive advantages.

The butterfly’s wings are strong. The question is; whether its nervous system can coordinate the increasingly complex flight patterns ahead.

The Butterfly’s Flight: Navigating Risks and Catalysts for Aurum PropTech

Just as a butterfly’s delicate wings must navigate shifting winds, Aurum PropTech faces headwinds even as it soars. Understanding these risks and growth drivers is key to seeing whether this PropTech butterfly can sustain its graceful flight.

Risks to Watch

Aurum’s rapid expansion has been impressive, but every high-growth journey carry pitfall.

- Intense Competition in PropTech: The real-estate tech space is crowded. Rental platforms (Nestaway, HelloWorld) vie with NoBroker and Housing.com, while co-living players (Stanza Living, Zolo) battle for beds. CRM and analytics tools (Sell.Do, Zoho CRM, Aurum Analytica) face off against global giants like Salesforce and regional specialists. Fierce price competition or customer churn could sap growth.

- Investment Burn and Capital Allocation: Building an integrated ecosystem requires heavy upfront spending, acquisitions, technology development, marketing, and operations. Aurum’s capex and M&A outlays drove losses through FY23–FY24. Though EBITDA turned positive in FY24 and surged in FY25, sustaining disciplined capital allocation is vital to avoid cash burn that outpaces revenue growth.

- Technology Adoption Challenges: PropTech adoption in India is still nascent. Many landlords, developers, brokers and tenants remain hesitant to replace traditional methods with software. Convincing each stakeholder to learn new systems and integrating with existing workflows (ERP, accounting, compliance) requires time and trust without which user engagement may lag.

- Macro Real-Estate Cyclicality: Real estate is sensitive to GDP growth, interest rates and regulation. A slowdown in housing demand or tighter borrowing norms could dampen rentals, co-living occupancies and developer budgets pulling demand away from Aurum’s solutions.

- Reliance on Acquisitions: A significant portion of Aurum’s growth has come via buying platforms at bargain valuations (NestAway, PropTiger). While acquisitions accelerate scale, they carry integration risks, cultural misalignment, and potential overpayment if valuations rise. Future deals at higher multiples may not deliver the same returns.

Catalysts for Growth

Despite these headwinds, Aurum PropTech is poised to benefit from powerful tailwinds and strategic initiatives.

- Urbanization and Digital Adoption: India’s urban population is set to grow from 35% today to nearly 40% by 2030. Younger, tech-savvy renters and first-time homebuyers increasingly prefer online platforms for property search, co-living, and fractional investments. Aurum’s end-to-end ecosystem directly addresses this shift.

New Product Launches - Secondary Home-purchase Platform: NestAway’s recently launched resale marketplace helps renters transition to owners, deepening customer lifetime value.

- Aurum Liv Enhancements: Expanding legal, furnishing, and post-purchase community services can drive up-sell and cross-sell revenue.

- MonkSpaces.AI Upgrades: Advanced space-optimization analytics for landlords and commercial operators can open new high-margin SaaS revenue streams.

- Expansion into Tier-II/III Cities: While Aurum’s core footprint spans top 15 cities, replicating its full ecosystem in smaller urban centers offers enormous untapped potential. Lower acquisition costs and increasing affordability in these markets can fuel the next wave of rental and sales volume.

- SM REIT Pipeline and Capital Markets: With SEBI-approved AMSA SM REIT schemes and BSE/NSE listing, Aurum can channel rental assets into liquid investment products. Rising institutional and retail appetite for REITs could unlock large-ticket capital inflows, boost fee income and reducing reliance on equity dilutions.

- Strategic Partnerships and Broker Networks: BeyondWalls’ broker aggregation and Sell.Do’s CRM integrations create network effects: more developers join the platform, attracting more brokers, which in turn generates more leads. As the network grows, Aurum can monetize value-added services like training, analytics subscriptions, and premium listings.

- AI-Driven Personalization and Cross-Selling: Aurum Analytica’s look-alike models combined with cross-platform data (rental histories, loan inquiries, investment behavior) enable highly relevant product recommendations—be it co-living options, home loans, or REIT units. This personalization can drive higher conversion rates and margin expansion.

Aurum PropTech’s wings are strong built on cutting-edge technology, strategic acquisitions, and a vision to serve every real estate need. Yet storms lie ahead in the form of fierce competition, integration complexity, and evolving regulations. Success hinges on disciplined capital use, seamless tech integration, and executing on growth levers like new product launches and Tier-II/III expansion.

Like a butterfly mastering each breeze, Aurum must harness these catalysts while deftly managing risks to maintain its elegant flight across India’s rapidly digitizing real estate skies.

What Stands Out in Aurum’s Approach

Like a caterpillar that methodically builds its cocoon before emerging as a butterfly, Aurum PropTech has taken a deliberately structured approach to transformation that sets it apart from typical startup stories.

The Full-Stack Philosophy: Most PropTech companies pick one lane rental platforms like NoBroker focus on listings, while co-living players like Stanza Living stick to beds. Aurum built the entire highway. From discovering properties (Aurum Analytica) to renting them (Nestaway, HelloWorld) to financing them (KuberX) to investing in them (WiseX, Integrow), they’ve created an ecosystem where each product feeds the next.

The Turnaround Specialist DNA: What’s remarkable is how Aurum didn’t just buy companies; they resurrected them. Nestaway was bleeding ₹950 mn annually when Aurum acquired it. Within three quarters, it hit break-even. HelloWorld was losing money; by FY24, it turned EBITDA-positive. This isn’t just capital injection, it’s operational magic.

The Patient Capital Strategy: In an industry obsessed with blitzscaling, Aurum chose calibrated expansion. HelloWorld operates in 15 cities but won’t expand unless it can achieve 45% gross margins in new properties. Nestaway downsized from 14 cities to 6, focusing on profitability over presence.

This is the butterfly approach build strength in the cocoon before attempting flight.

The Swiss Army Knife of Real Estate

Traditional PropTech companies are like single-purpose tools, a hammer (listings) or a screwdriver (payments). Aurum is the Swiss Army knife, one platform, multiple capabilities, all working together. Need a rental? Check. Need leads for your project? Check. Need financing? Check. Need to invest surplus cash? Check.

Conclusion: The Road Ahead for Aurum PropTech

Standing at the threshold between cocoon and butterfly, Aurum PropTech finds itself in that delicate moment of transformation. The foundation is solid, integrated platforms, improving unit economics, a clear path to profitability. But the sky ahead holds both sunshine and storms.

The Opportunity is Immense

India’s ₹1 trillion real estate market by 2030 represents a canvas vast enough for multiple winners. With 75% of homebuyers now using digital platforms and organized rental supply meeting just 4% of demand, Aurum is positioned at the confluence of massive tailwinds. Their integrated approach means they don’t just ride one wave; they surf the entire ocean.

But Caution is Required

The PropTech graveyard is littered with companies that grew too fast, burned too much, or couldn’t convince traditional stakeholders to adopt new ways. Aurum’s disciplined approach offers protection, but execution remains everything. Each acquisition must integrate seamlessly, each product must deliver promised unit economics, each market expansion must generate sustainable returns.

The Butterfly Test Ahead

Success for Aurum won’t be measured just in revenue growth (though the projected 46% CAGR to FY27E looks promising). It will be in whether they can prove that the whole truly exceeds the sum of its parts; whether cross-selling works, whether data from one vertical improves performance in others, whether their ecosystem creates switching costs that competitors can’t overcome.

The real test: Can they fly as gracefully as they’ve transformed?

As the ancient proverb goes: “Just when the caterpillar thought the world was over, it became a butterfly.” For Aurum PropTech, the metamorphosis is nearly complete. Whether they soar or struggle will determine not just their fate, but potentially the future of India’s PropTech evolution.

Ethica: Your Compliant Investment Pipeline Tool

Ethica works on an investment thesis that brings you selected Shariah-compliant stocks based on deep research into operations and financials for the company. With SEBI-registered analysts, we aim to make sure, we do a full due diligence on any given stock we recommend. For this stock, the team has taken up:

- Financial due diligence- Checking the financials, order book, con-calls, and other details to make sure claims from the promoters/management are not without any base.

- Deep dive into the industry- How does the industry work for the company? And how does the company stand in the industry? These are two important questions that need to be asked before analysing a company.

In today’s AI-driven investing world, there’s still one thing no algorithm can replace; human intuition. Numbers and models can tell you a lot, but they can’t always catch what really matters beneath the surface. When it comes to understanding Aurum PropTech’s growth story and revenue potential, some insights still require human investigation and judgment. At Ethica, we combine advanced analytical tools with real human reasoning to uncover investment opportunities that machines alone would miss.